As we enter 2025, the landscape for U.S. tech unicorns—startups valued at $1 billion or more—appears to be at a critical juncture. According to the PitchBook/NVCA Venture Monitor report from Q4 of 2024, a number of unicorns are poised to go public this year. However, this optimism must be tempered with a thorough understanding of the underlying issues impacting the venture capital (VC) sector. The utilization of machine learning tools, such as PitchBook’s VC exit predictor, allows a more precise assessment of startups’ potential for successful exits. Scoring these companies with exit probabilities provides a valuable perspective, especially amid concerns surrounding inflated valuations and regulatory hurdles.

The Disconnect in Valuation

One of the most pressing challenges confronting the VC landscape in 2025 is the persistent disconnect between buyer and seller expectations when it comes to valuations. Nizar Tarhuni, Executive Vice President of Research and Market Intelligence at PitchBook, articulated that while there has been an uptick in investment and financing, the ongoing pressure generated by inflated valuations from earlier funding rounds is causing delays in meaningful exits. Investors must recalibrate their expectations concerning valuation, structuring, and potential growth in an environment increasingly characterized by complexity.

The challenges are exacerbated by regulatory issues that dampen deal appetites across various sectors. Tarhuni’s insights highlight a cautious optimism for 2025, as potential regulatory shifts could ease liquidity challenges and foster a more conducive environment for mergers and acquisitions (M&A). As the political climate transforms, a business-friendly stance in Washington could invite renewed engagement from investors and alter how startups strategize their growth and exit plans.

The potential for positive changes in the regulatory landscape has resonated with key figures in the venture capital community. Bobby Franklin, CEO of the National Venture Capital Association (NVCA), notes that recent leadership changes within the Federal Trade Commission (FTC) and the Department of Justice (DOJ) could reduce the barriers to liquidity for portfolio companies. Additionally, evolving regulations from the Securities and Exchange Commission (SEC) may help to alleviate some burdens faced by firms, creating an environment where innovation can thrive.

Franklin’s comments underscore a broad optimism for VCs and entrepreneurs as they move into 2025. The several adjustments pending in Congress, including a significant tax bill, could play a transformative role by incentivizing innovation and reinstating the R&D tax credit. Such measures could provide the necessary support to nurture the broader startup ecosystem. Competitive funding environments mean established venture firms could benefit from these shifts, potentially sidelining newer or smaller players as they vie for precious investment dollars.

Looking specifically at companies with the best odds of going public in 2025, the findings suggest that several familiar names are leading the pack. For instance, Anduril, co-founded by tech entrepreneur Palmer Luckey, holds a remarkable 97% chance of successfully completing an IPO. Similarly, Mythical Games, a player in the burgeoning Web3 space, also shares this optimistic prediction. Other notable contenders include companies such as Ayar Labs, Carbon, and StockX, all of which sit favorably within the potential IPO landscape.

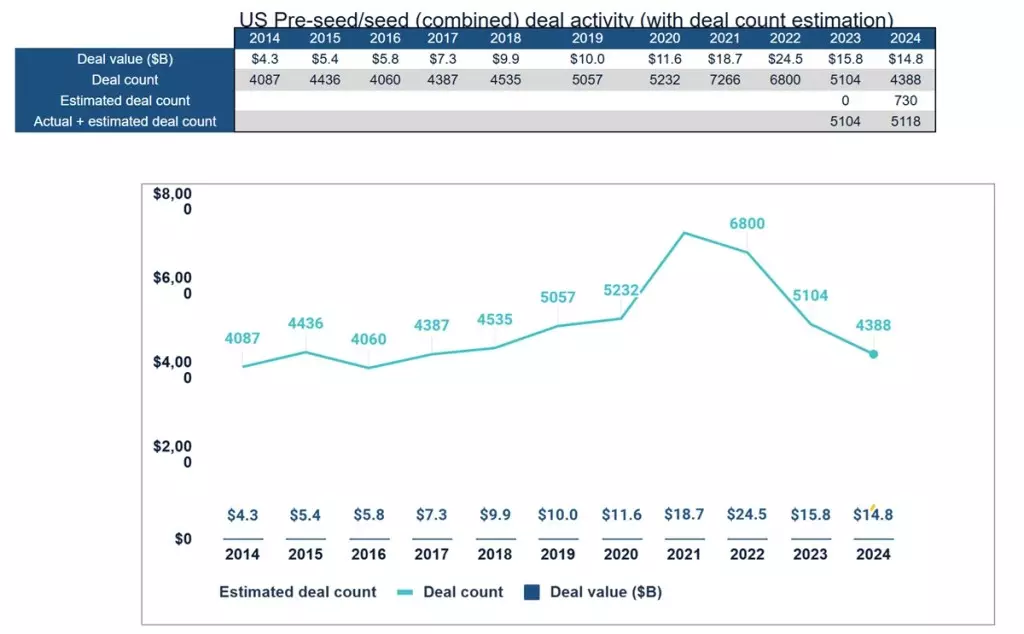

While the prospect of successful IPOs provides a silver lining for investors, it’s essential to assess the overall health of the venture ecosystem. 2024 saw a notable decline in early-stage investments, particularly in the $1 million to $5 million fundraising range—this drop from previous peaks signifies a cautious approach amongst investors. Understanding these trends will be crucial for startups seeking to navigate the turbulence the sector is experiencing.

While 2025 presents an array of promising IPO opportunities for U.S. unicorns, the journey is riddled with regulatory challenges and valuation discrepancies that need addressing. Venture capitalists and entrepreneurs must adapt to the shifting market dynamics, recalibrating their strategies in order to thrive. With potential changes at the governmental level and a clearer understanding of funding landscape shifts, there lies hope for a revitalized venture ecosystem. The coming year will serve as a critical test, not merely for the unicorns looking to establish themselves in public markets, but for the entire ecosystem that fuels innovation in the United States.

Leave a Reply