Uber Technologies, Inc., the ride-sharing giant that has revolutionized transportation, recently reported its fourth-quarter results, which presented an interesting juxtaposition of strong revenue growth against cautious future expectations. While the company did surpass analysts’ predictions for revenue, the subsequent share price drop in premarket trading serves as a reminder of the complexities involved in sustaining investor confidence.

Uber’s fourth-quarter performance showcased remarkable resilience and growth in revenue, reporting figures that exceeded market expectations. The company achieved earnings per share (EPS) of $3.21, significantly higher than the anticipated $0.50. Revenue also saw a notable increase, landing at $11.96 billion, compared to the expected $11.77 billion. This translates to a robust annual revenue growth of 20%, climbing from $9.9 billion in the same quarter the previous year. Perhaps most striking was the reported net income of $6.9 billion, which showed a dramatic increase from the $1.4 billion reported for the same period last year.

However, these impressive numbers were bolstered by considerable one-time benefits, including a substantial $6.4 billion tax valuation release. This raises concerns about the sustainability of profitability when adjusting for such non-recurring items. Furthermore, Uber’s gross bookings also outperformed estimates, reflecting consumer demand for their services.

Delving into the specifics, Uber’s Mobility and Delivery segments revealed a balanced performance, each posting a gross booking figure of $22.8 billion and $20.1 billion, respectively, both up by 18% year over year. Notably, the Mobility segment’s revenue climbed to $6.91 billion, outstripping analyst expectations. Conversely, the Delivery segment also exceeded predictions with a revenue of $3.77 billion.

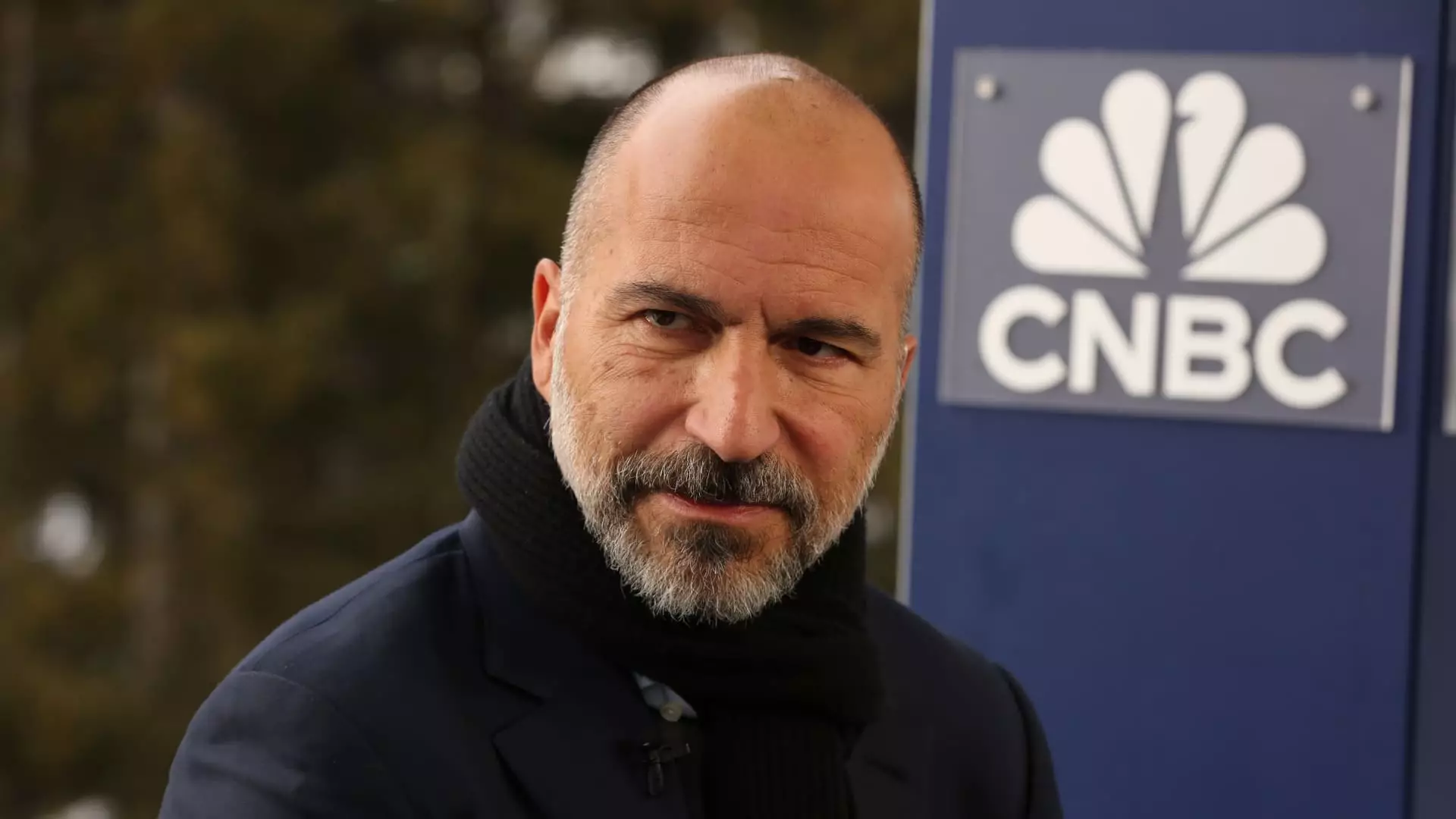

Nevertheless, the freight division remained static, reporting $1.28 billion, matching last year’s figures but falling short of expectations. CEO Dara Khosrowshahi acknowledged the ongoing challenges in this area, attributing them to shifting consumer spending patterns post-pandemic, where people are prioritizing services over goods.

Forward Guidance: Caution Amidst Optimism

In terms of guidance for the first quarter, Uber projected gross bookings in the range of $42 billion to $43.5 billion, slightly underlining the expectations of $43.51 billion from analysts. Moreover, the anticipated adjusted EBITDA falls within a somewhat narrow margin of $1.79 billion to $1.89 billion, which aligns closely but still does not offer the aggressive outlook some investors might desire.

The mixed signals from these figures can create a precarious situation for investor sentiment, which was perhaps reflected in the approximately 7% decline in share price following the earnings announcement. This suggests that while the current performance metrics are robust, investors are wary of what the future holds, particularly in relation to the projected downward adjustments.

Driving Innovation: Autonomous Vehicles and Market Expansion

One area where Uber is investing significant resources is the development of autonomous vehicles. The announcement of the impending launch of robotaxi rides in Austin, Texas, through a collaboration with Waymo, indicates an aggressive strategy aimed at capitalizing on technological advances that could redefine the ride-sharing landscape. With the roll-out of these services, Uber signals a commitment not only to innovation but also to strategic partnerships that could enhance its long-term market position.

The company also noted the completion of 3.1 billion trips on its platform during the fourth quarter, reflecting a year-over-year growth of 18%. Furthermore, the growth in monthly active users—reaching 171 million—demonstrates strong consumer engagement. This solidifies Uber’s relevance in an increasingly competitive environment, especially as it ventures into new technological territories.

As Uber moves into the new fiscal year, the mixed results highlight the company’s triumphs and tribulations. While the immediate financial results display impressive growth, the caution exhibited in future guidance raises critical questions regarding the sustainability of such advancements in an evolving market. Moreover, with the ongoing innovations in autonomous vehicle technology, Uber’s strategic path forward remains ambitious yet uncertain. The juxtaposition of strong current performance against a backdrop of cautious outlooks illustrates a pivotal moment in Uber’s trajectory, showcasing both the potential for transformative growth and the inherent risks that accompany such ambitions.

Leave a Reply