On Wednesday, Nvidia is poised to release its fourth-quarter earnings, a report that analysts and investors alike anticipate with keen interest. According to estimates from LSEG, the consensus projections indicate an adjusted earnings per share (EPS) of $0.84 and revenues hitting approximately $38.04 billion. This forthcoming earnings announcement is crucial for understanding the company’s trajectory as it caps off what has been an extraordinary fiscal year, characterized by remarkable growth metrics and significant market shifts driven largely by demands in artificial intelligence (AI).

Looking back over the past year, Nvidia’s financial performance has been nothing short of phenomenal. Analysts are projecting a 72% increase in revenue for the quarter ending January, contributing to a staggering forecast for total fiscal year revenues surpassing $130 billion—more than doubling from previous levels. This surge can be credited largely to the explosion of demand for Nvidia’s data center graphics processing units (GPUs), which have become fundamental for the development and execution of AI applications, most notably exemplified by products such as OpenAI’s ChatGPT.

The rapid ascent of Nvidia’s stock price over the past two years—rocketing over 440%—has even secured its position as the most valuable publicly traded company in the United States at certain points, with its market capitalization soaring to over $3 trillion. Such figures illustrate the vitality and competitive edge of Nvidia in the market, reflecting a broader shift towards AI technologies.

Despite its impressive growth, Nvidia faces a series of pressing challenges that could impact its future performance. In recent months, the pace of its stock’s appreciation has decelerated significantly, with share prices stabilizing at levels comparable to those seen last October. One critical worry among investors centers around potential caution from major customers—hyperscale cloud companies—who are anticipated to review and possibly restrain their capital expenditures following a prolonged period of aggressive investments.

Moreover, the emergence of competing technologies, such as the Chinese AI model DeepSeek’s R1, raises concerns about Nvidia’s market dominance and the necessity for its chips in the evolving AI landscape. This shift could invite scrutiny from U.S. regulators, potentially influencing export restrictions on Nvidia’s advanced AI chips to China on national security grounds, an issue that is already poised to shape Nvidia’s operational landscape.

Investor sentiment surrounding Nvidia’s prospects is further complicated by indications of slower-than-expected rollouts of its latest AI chips, particularly the Blackwell series. Reports suggest that distribution challenges could stem from issues related to product yield and thermal management, which may undermine Nvidia’s competitive edge. Recently disclosed estimates from analysts reveal that companies like Microsoft, Google, Oracle, and Amazon account for a significant share of spending on Nvidia’s chips, further underlining the importance of these customers to the company’s financial health.

The unease among investors was heighted last week when reports emerged that Microsoft had been scaling back its leasing agreements with private data center operators, prompting fears that AI infrastructure expansion, heavily reliant on Nvidia’s products, may falter. Yet, Microsoft has countered these concerns, affirming its commitment to spend $80 billion on its infrastructure in the coming year.

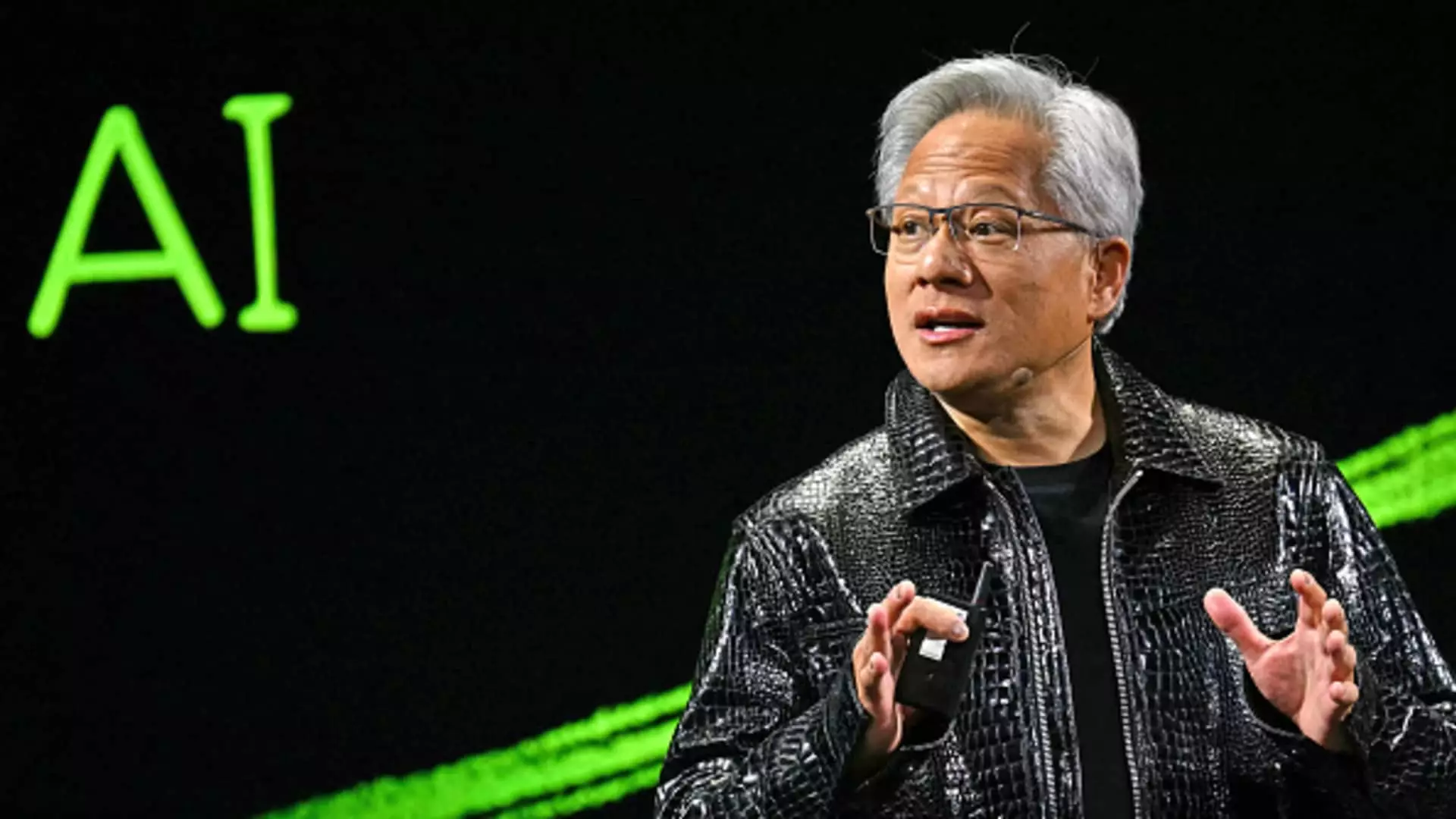

With anticipation building, investors will be looking to Nvidia’s leadership, particularly CEO Jensen Huang, for insights regarding the company’s relationships with hyperscale cloud providers and the overall health of the AI ecosystem. During the earnings call, stakeholder expectations will likely revolve around guidance for fiscal 2026, with a focus on what percentage of growth can realistically be anticipated from last year’s high sales levels.

As Nvidia prepares for its earnings report, the interplay of impressive growth metrics with emerging challenges paints a complex picture. The ability of this industry titan to navigate its ongoing relationship with key customers, address supply chain hurdles, and maintain its position in the competitive AI landscape will be critical factors influencing its future trajectory.

Nvidia’s upcoming earnings release is not just a routine financial report; it serves as a critical touchpoint for assessing the health of a company at the forefront of the AI revolution and for evaluating its sustainability in maintaining its market position amidst evolving challenges. How it addresses these dynamics in its communication will undoubtedly shape investor sentiment in the quarters to come.

Leave a Reply