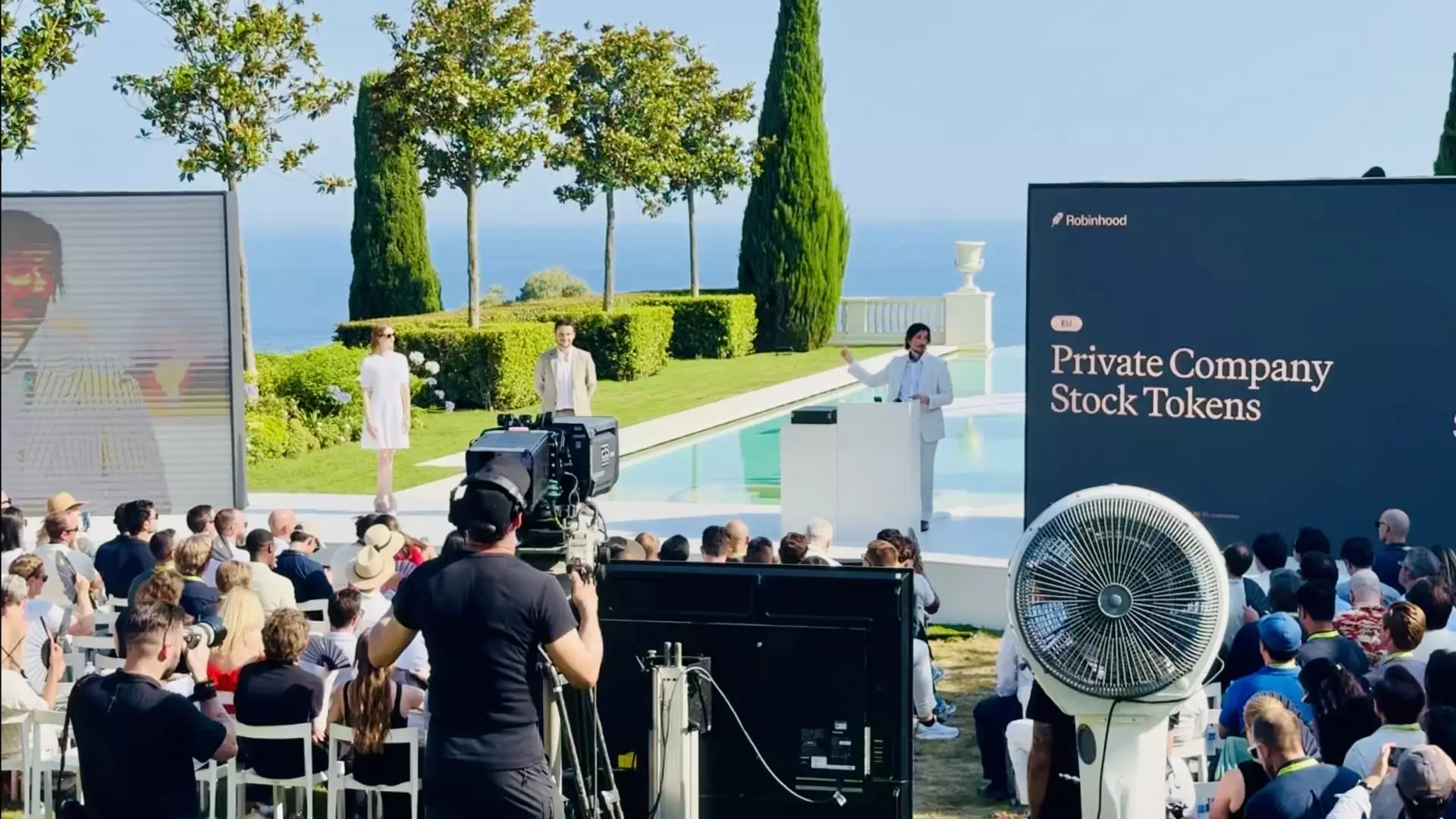

Robinhood’s recent announcement has sparked major excitement in the fintech and crypto communities, marking an unprecedented milestone in investment accessibility. By introducing tokenized shares of private entities such as OpenAI and SpaceX, Robinhood is breaking historical barriers that have long restricted private equity ownership to a select few — typically insiders and ultra-wealthy investors. This initiative, which debuted in Europe, is not just a product launch; it’s a bold statement that signals a new era of financial democratization leveraging blockchain technology.

Traditionally, access to private companies has been shackled by legal and financial constraints, essentially locking out everyday investors from the growth potential of industry titans like OpenAI and SpaceX. Robinhood’s move to tokenize these shares—essentially representing equity in these private firms as blockchain-based digital assets—opens ownership to a much wider audience via their EU crypto app. This marks a conspicuous shift that redefines who can participate in wealth generation from cutting-edge tech companies, eroding old financial hierarchies.

Why Europe, and Why Now?

A critical enabler for Robinhood’s leap into tokenized private equity is Europe’s relatively flexible regulatory framework compared to the United States. Unlike the U.S., where stringent “accredited investor” rules severely constrain who can access private securities, the EU’s regulatory environment allows far broader participation. Robinhood’s decision to initially limit this rollout to Europe isn’t incidental but a calculated response to regulatory realities.

This geographic strategic choice underscores a broader truth about innovation in financial markets: regulatory environments profoundly impact what is technologically and commercially feasible. Europe’s willingness to accommodate novel blockchain-based securities is fostering an ecosystem ripe for groundbreaking financial products. Robinhood’s team leveraged this to pilot their tokenized private equity program, hoping to demonstrate proof of concept and build momentum in a supportive jurisdiction before contemplating a future U.S. expansion.

The Blockchain Edge and Its Implications

Tokenization fundamentally transforms how equity is traded and held. The use of blockchain technology provides transparent, immutable records of ownership and more efficient settlement processes. By launching tokenized shares on their own custody wallet and their Layer 2 blockchain infrastructure on Arbitrum, Robinhood is building a seamless, modern ecosystem for asset management.

This infrastructure doesn’t merely support more accessible investing but lays groundwork for a future where fractional ownership and 24/5 trading without hidden commission or spreads become the norm. Traditional equity markets can be rigid and slow, with significant cost and complexity barriers. Robinhood’s blockchain approach reduces these frictions, which could redefine market liquidity and investor experience, particularly for retail participants.

Additionally, integrating tokenized shares with a crypto staking feature — already rolled out for Ethereum and Solana in the U.S. — indicates Robinhood’s ambition for a wider crypto-financial integration. Yield generation through staking, previously blocked by U.S. regulators, now forms part of Robinhood’s renewed strategy to reintroduce innovative crypto products domestically, signaling their commitment to bridging traditional and digital financial worlds.

Challenges and Limitations Ahead

Despite this optimistic vision, significant hurdles remain for Robinhood’s model, especially in the U.S. market. The longstanding “accredited investor” restrictions protect ostensibly inexperienced investors from high-risk private securities but simultaneously serve as gatekeepers to opportunity. Robinhood CEO Vlad Tenev’s calls for regulatory reform highlight a clash between innovation and regulatory conservatism.

Regulators are wary of investor protection concerns surrounding unvetted access to illiquid and complex assets. While tokenization can improve transparency and accessibility, it does not entirely eliminate risks. Educating investors about the volatility and inherent risk in private equity shares remains essential. Without regulatory adjustments or new frameworks tailored for tokenized assets, Robinhood’s U.S. expansion of private equity tokenization may be stymied, at least in the near term.

Furthermore, while the no-fee trading and broad availability sound enticing, skepticism remains about how Robinhood will manage liquidity and valuation accuracy for these novel assets. Markets in closely held private companies fundamentally differ from large public stock exchanges, and maintaining fair pricing and orderly markets can be difficult.

Why It Matters: A Paradigm Shift in Accessing Private Capital

At its core, Robinhood’s initiative is more than a technical innovation; it represents a vision to rebalance access to wealth-building opportunities. The historic concentration of private equity ownership in handpicked elites has contributed to staggering socioeconomic divides. By tokenizing shares of companies at the frontier of technological innovation and opening them to the general public, Robinhood aims to chip away at these inequalities.

Though the journey is only beginning and the challenges many, this step has powerful symbolic and practical implications. It invites everyday investors into spaces previously reserved for venture capitalists and hedge funds, potentially reshaping investment landscapes globally. The move prioritizes inclusivity embedded in technology and regulatory adaptability, signaling a future where private markets could offer the same accessible liquidity and transparency that public markets now strive to provide.

Robinhood’s gamble on tokenized private shares — pioneering, ambitious, and not without risks — may well serve as a blueprint for the future of investing, democratizing ownership and harnessing blockchain’s disruptive potential in truly transformative ways.

Leave a Reply