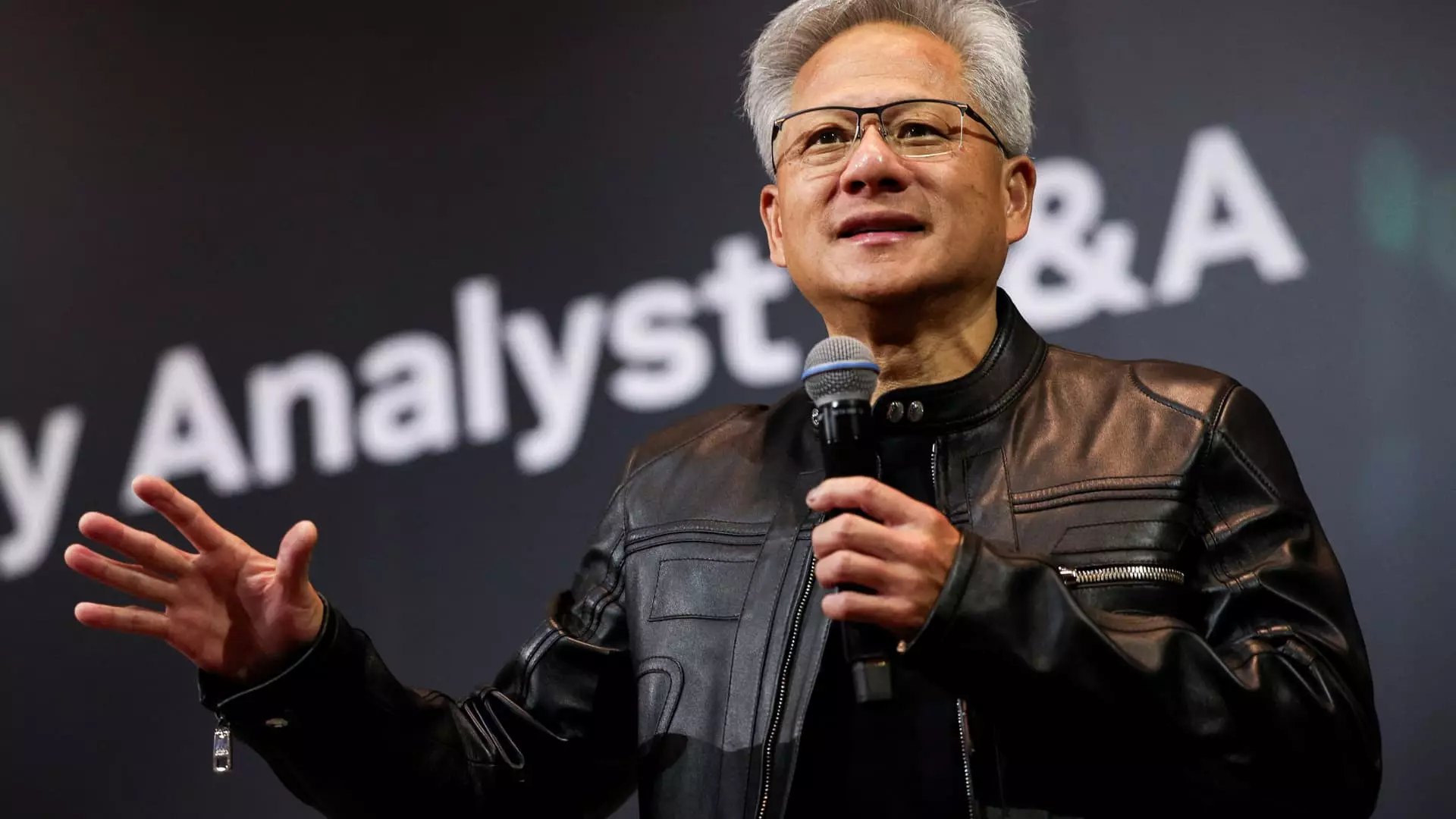

In the fast-evolving arena of global technology, few companies hold as much strategic significance as Taiwan Semiconductor Manufacturing Company (TSMC). As the world’s top contract chip manufacturer, TSMC’s influence extends well beyond its borders, shaping the entire supply chain for the semiconductor industry. Recognizing this, industry leaders like Nvidia’s CEO Jensen Huang openly praise TSMC, emphasizing its unparalleled role in technological innovation. Such endorsements are not mere pleasantries but calculated signals of acknowledgment that underscore TSMC’s centrality to the future of advanced computing and AI development.

Huang’s glowing remarks—calling TSMC “one of the greatest companies in the history of humanity”—are a clear testament to the importance Nvidia places on its partnership with Taiwan’s leading chipmaker. These comments serve more than just appreciation; they are strategic affirmations that reinforce the critical dependency on TSMC’s manufacturing prowess. Such praise can also be viewed as an implicit recognition of the huge stakes involved in semiconductor leadership, where control over cutting-edge manufacturing processes confers a substantial competitive advantage.

The Geopolitical Chessboard: U.S. Policies and Global Tech Power Plays

The geopolitical landscape surrounding semiconductors is undergoing a seismic shift. The United States, under the banner of the CHIPS Act, has been actively seeking to bolster its domestic chip manufacturing capabilities. This initiative involves significant government investments—awarding billions in grants and loans aimed at revitalizing U.S. semiconductor production. However, it also introduces complex political dynamics, especially as Washington considers acquiring stakes in foreign companies like TSMC, Micron, and Samsung, whether directly or through strategic investments.

U.S. officials, including Commerce Secretary Howard Lutnick, have signaled intentions to take equity positions in key industry players—an approach that marks a significant departure from traditional models of industrial partnerships. While these moves aim to secure the supply chain, lock in technological dominance, and prevent reliance on foreign entities, they also risk igniting diplomatic tensions. TSMC’s substantial investment in U.S. facilities, particularly in Arizona, reflects Washington’s desire to insulate itself from potential supply chain disruptions, but it also raises questions about the long-term geopolitical implications of increased U.S.-Taiwan-China tensions.

This intricate geopolitical dance becomes even more complicated as China raises security concerns related to Nvidia’s chips tailored for its market. The reported halting of component supplies to Nvidia’s H20 chips, amidst China’s restrictions on purchases, illustrates how geopolitical conflicts can directly influence corporate operations. These situations highlight the fragile balance between technological innovation and national security, emphasizing that semiconductor technology is as much a geopolitical tool as it is a commercial asset.

The Future of Innovation: The Race for Technological Supremacy

Nvidia’s plans to expand its presence in Taiwan through initiatives like the new “NVIDIA Constellation” office demonstrate a strategic understanding of where future innovation hubs will thrive. Taiwan’s critical role in the global supply chain makes it an indispensable node for Nvidia’s growth, especially as the company accelerates efforts in AI, GPU development, and next-generation computing technologies.

Huang emphasizes this point by noting the growing workforce and supply chain activity in Taiwan. For Nvidia, the strategic location facilitates rapid access to cutting-edge manufacturing and engineering talent. The company’s desire to grow locally isn’t just about logistics—it’s about embedding itself within a geopolitical nexus that could define the future of global tech dominance. The collaboration with local governments and chip companies underscores an understanding that sustained innovation depends on strong ecosystems, not just isolated corporate efforts.

Furthermore, Nvidia’s recent cautious handling of its chips designed for China reflects the ethical dilemmas faced by tech companies operating in this geopolitical environment. While Nvidia works toward resolving export restrictions and navigating security concerns, it exemplifies the tightrope walk companies must do—balancing technological advancement with compliance and geopolitical sensitivities.

The Power Struggle and Its Implications for Global Leadership

The grand chess game of semiconductor dominance is predicated on control—not only over manufacturing processes but also over geopolitical influence. TSMC’s expansion plans, including a mammoth $165 billion investment in the U.S., exemplify a broader strategy to anchor global supply chains outside regional flashpoints. Such investments serve dual purposes: securing international markets and asserting Taiwan’s pivotal role in the global tech ecosystem.

Meanwhile, Washington’s flirtation with acquiring stakes in foreign semiconductor companies underscores an ambitious attempt to monopolize technological leadership, risking a new Cold War-like scenario. The implications are profound: companies like Nvidia and TSMC are no longer mere service providers—they become key players in a global power struggle with high stakes for technological sovereignty.

The evolving narrative indicates that semiconductor companies will increasingly be embroiled in geopolitical strategies rather than operate solely as commercial entities. For industry leaders, understanding this shift is essential. It’s no longer enough to innovate; they must navigate a complex landscape of international policies, national security concerns, and economic incentives—all while maintaining their competitive edge.

—

In this theater of geopolitical chess, TSMC’s status as a technological powerhouse and strategic asset is indisputable. Its partnerships, investments, and the recognition from global leaders like Jensen Huang are indicative of a future where control over semiconductor manufacturing equates to global influence. As nations jostle for dominance, the companies at the heart of this revolution will define the next chapter of technological history—and those who recognize and adapt to these dynamics early will undoubtedly shape the future landscape of innovation.

Leave a Reply