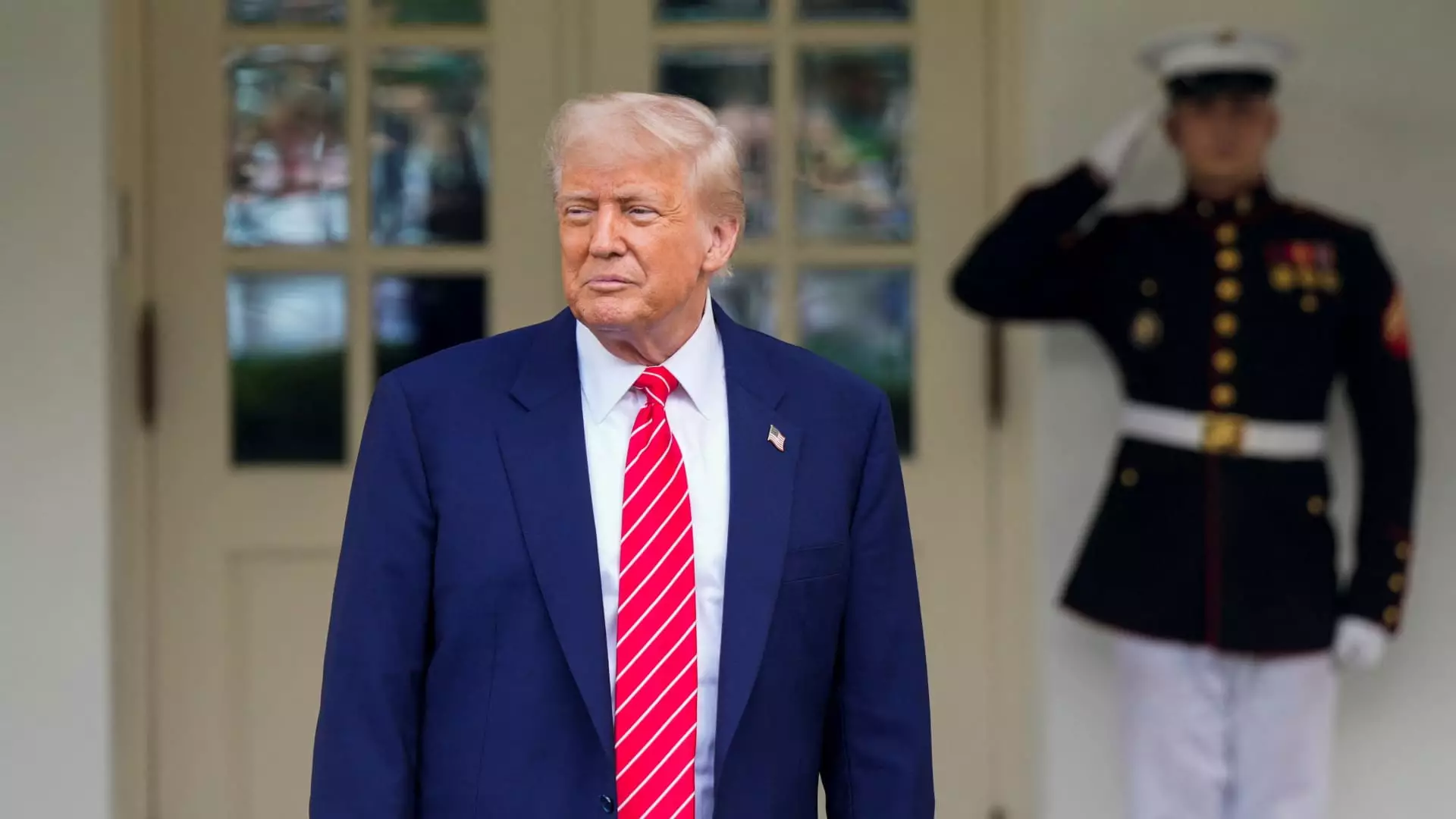

The ongoing saga of cryptocurrency legislation in the United States serves as a poignant example of how personal conflicts of interest can derail the broader objectives of innovation and governance. President Donald Trump’s foray into the cryptocurrency arena has inadvertently transformed the legislative landscape into a battleground of ethics and integrity, thwarting critical progress towards establishing rules for burgeoning digital assets. Lawmakers have recently expressed grave concerns regarding the President’s financial entanglements—concerns that seem to underscore a more significant crisis within the political and economic frameworks of the nation.

During the recent failure of the GENIUS Act, a bill designed to set federal guidelines for stablecoins, dissent erupted amid apprehensions that Trump’s personal investments might compromise the neutrality required for effective legislation. Senator Jeff Merkley from Oregon articulated these fears with clarity, labeling the intersection of Trump’s personal crypto ventures with governmental policy a “profoundly corrupt scheme.” The backdrop of Trump’s controversial ventures epitomizes a deterioration of trust in government and raises questions about national security—issues that are impossible to navigate without transparency.

The Climactic Failures of the GENIUS Act

The GENIUS Act fell flat, failing to garner the necessary votes to reach the Senate floor for deliberation. This outcome is emblematic of a broader political climate where the razor-thin majority for Republicans complicates any legislative effort. Despite a handful of Democrats signaling their support for stablecoin regulation, the specter of Trump’s business interests proved a formidable barrier. The act not only aimed to clarify regulations surrounding stablecoins—digital currencies tethered to stable assets—but also had the potential to deliver a coveted bipartisan victory. Yet, the chaotic fallout from Trump’s personal cryptocurrency ventures, including his $TRUMP meme coin, ensnared the legislative efforts in a web of scrutiny and distrust.

The allure of profit has evidently driven critical stakeholders to reconsider their positions. Investor sentiment has shifted as the implications of Trump’s personal wealth intertwined with public policy create a troubling precedence. The Trumpcoin initiative—alongside other ventures like World Liberty Financial—have fed into this complex narrative. The promotion of exclusive deals involving cryptocurrency holdings, such as dinners with the president, raises ethical red flags and promotes the perception of a “pay-for-play” environment. Senator Richard Blumenthal has vocally criticized these actions as an affront to fair governance, bringing to light the ugly reality of personal gains being pursued at the expense of public interest.

The Ripple Effect on Future Legislation

The failure of the GENIUS Act could have far-reaching consequences, influencing not only cryptocurrency policies but other sectors of economic innovation as well. The burgeoning crypto industry, previously buoyed by bipartisan financial support, might struggle under the shadow of these conflicts. Investors, entrepreneurs, and advocates find themselves caught in a quagmire created by a sitting president whose business motives clash violently with the public good.

As lawmakers like Senator Kirsten Gillibrand continue to push for rigorous consumer protections and regulatory clarity, the obstruction experienced in the Senate highlights an urgent need for legislative consistency that is currently at risk. The Democratic undertow, particularly in response to Trump’s persistent conflicts, has mobilized calls for stronger provisions that address broader concerns beyond mere stablecoin frameworks. The recently proposed “End Crypto Corruption Act” reflects a growing movement among legislators to address the conflicts plaguing crypto legislation, but it remains mired in partisan disunity.

Investors Demand Integrity and Growth

As discourse around the interplay of personal profit and public policy intensifies, despair is evident in the investor community. The cryptocurrency sector, which thrives on innovation and venture capital, appears to be at odds with the self-serving motivations of its leader. Ryan Gilbert, a prominent figure in fintech, encapsulated the sentiments of many when he lamented that “personal business is getting in the way of good policy.”

The stakes cannot be overstated. The potential for intense investment and technological progress risks being eclipsed by the specter of the Presidential conflict of interest—a reality with devastating implications not just for crypto but for the U.S. economy at large. In an age where digital currencies promise to revolutionize finance, the ability of lawmakers to regulate these sectors responsibly increasingly hangs in the balance.

As scrutiny grows over Trump’s financial machinations, there is a palpable sense of urgency among those invested in both cryptocurrency and the democratic process. The repercussions of allowing personal ambitions to interfere with regulatory frameworks could prove dire, stunting innovation and entrenching a shadow of doubt over the intentions of policymakers. The legislation remains stalled, and the outlook is murky, but the call for clarity and integrity remains resonant. The path to a well-regulated digital asset landscape may now depend largely on the ability to disentangle personal interests from the public sphere—a monumental challenge in the landscape heavily shaped by figures like Trump.

Leave a Reply