Recently, President Donald Trump pivoted in his approach to tariffs specifically targeting the technology sector. In a strategic move, it was announced that consumer electronics would be exempt from hefty tariffs previously imposed—ranging from 145% on certain goods manufactured in China, along with an additional 10% global tariff. This exemption includes vital components like semiconductors, which function as the backbone of virtually all electronic devices, from smartphones to laptops. By making this adjustment, Trump is aligning his policies more closely with the broader wisdom of economic advisers who warn that such tariffs could stifle innovation and economic growth.

While this shift may signal a reduction in immediate economic tension, there remains uncertainty surrounding its potential to rebuild investor confidence. The stock market, which has declined by approximately 15% since Trump’s inauguration, is indicative of deeper systemic anxieties. Investors are not merely reacting to policy changes; they are responding to the unpredictable nature of Trump’s trade decisions. The perceived inconsistency breeds hesitancy, making people question whether these exemptions will truly stimulate the economy or simply serve as a temporary balm for deeper issues at hand.

The Ripple Effect on Consumer Electronics

Tariffs on electronics threaten to impact consumers directly and profoundly. Prior to the recent exemptions, estimates suggested that the tariffs could lead to a staggering increase in prices; for instance, a gaming console could see a 40% price surge, while smartphones could become 26% more expensive and laptops potentially rise by 46%. Such monumental price increases would inevitably decrease consumer purchasing power and stifle sales, affecting not only corporate profits but also everyday consumers who rely on these technologies.

Consider the implication of a smartphone, traditionally priced at around $1,000, potentially skyrocketing to $3,500 if manufactured domestically. Critics assert that such drastic measures overlook crucial aspects of the current global market; the U.S. has only a fraction of the market share needed to support the high demands of tech giants like Apple. The increasingly complex dynamics in the semiconductor market, heavily influenced by foreign competitors such as Taiwan’s TSMC, reflect how tariffs alone may do little to rectify the systemic challenges that have built up over decades.

The Long-Term Vision for U.S. Manufacturing

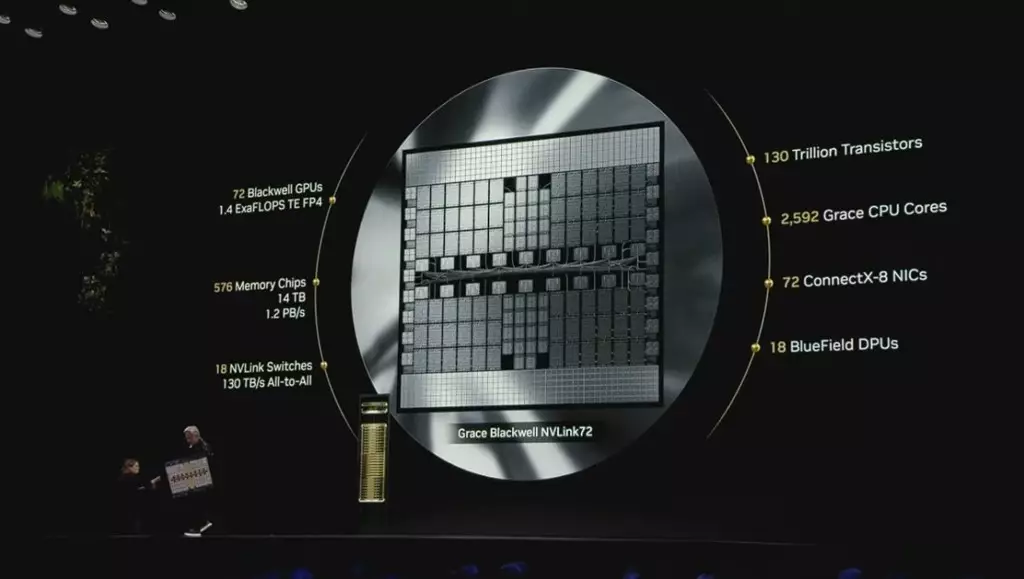

While the exemption may seem beneficial in the short term, a deeper examination reveals that regaining lost ground in the semiconductor market will not be quick or easy. Insights from industry experts, such as Scott Almassy from PwC, illuminate the complexity involved in rebuilding this vital sector. Tariffs may create immediate disruptions, but the long game requires a comprehensive strategy involving investment in materials and technology, alongside creating a labor force equipped with skills necessary to thrive in the semiconductor field.

In conversation with professionals from Deloitte, it becomes clear that establishing semiconductor manufacturing facilities in the U.S. will not happen overnight. Bolstered by the U.S. Chips and Science Act, expected to channel billions into the industry, it is anticipated that even with robust investment, the U.S. could only regain a modest share—moving from around 10% to possibly 14% of global semiconductor production by 2032. This slow and arduous path showcases just how entrenched the challenges from decades of offshoring and global market displacement can be.

The Critical Role of Workforce Education

A critical, often overlooked aspect of the tech industry’s future lies in its human resources. The highly specialized jobs created within this sector require a well-educated workforce capable of innovating and contributing to rapid advancements. However, as observed, the U.S. currently falls short in mathematics and science education compared to nations like China, which produces a greater number of engineers. This systemic educational inadequacy complicates any efforts to rebuild the domestic semiconductor industry.

While policymakers may push for onshoring manufacturing based on the desire to reclaim competitiveness, the reality is multifaceted. As noted, President Trump’s approach could be seen as a call to action for tech companies to invest heavily in U.S. operations. However, merely incentivizing companies to shift facilities back to American soil will not be sufficient; it must coincide with a transformation in educational frameworks to cultivate a pipeline of necessary talent.

The Complexity of Trade Relationships

In the broader scheme of global trade relations, one thing remains clear: tariffs alone will not rectify the imbalances created with significant trading partners such as China. The realignment of policies will need to be complemented by revitalized diplomatic engagements, especially in discussions related to technology, to pave the way for favorable trade practices that benefit both the U.S. and its allies. The influence of the tech industry on the lobbying landscape strikes a chord, as these entities hold immense value in their ability to create jobs and bolster the economy, which should be a primary concern for American policymakers.

Ultimately, the emerging dynamics necessitate a sophisticated understanding of technology’s role in contemporary economics, far beyond mere tariff adjustments. As America looks to reclaim its status in the global tech landscape, the intricate dance between policy, education, and industry will be pivotal in ensuring its long-term success.

Leave a Reply