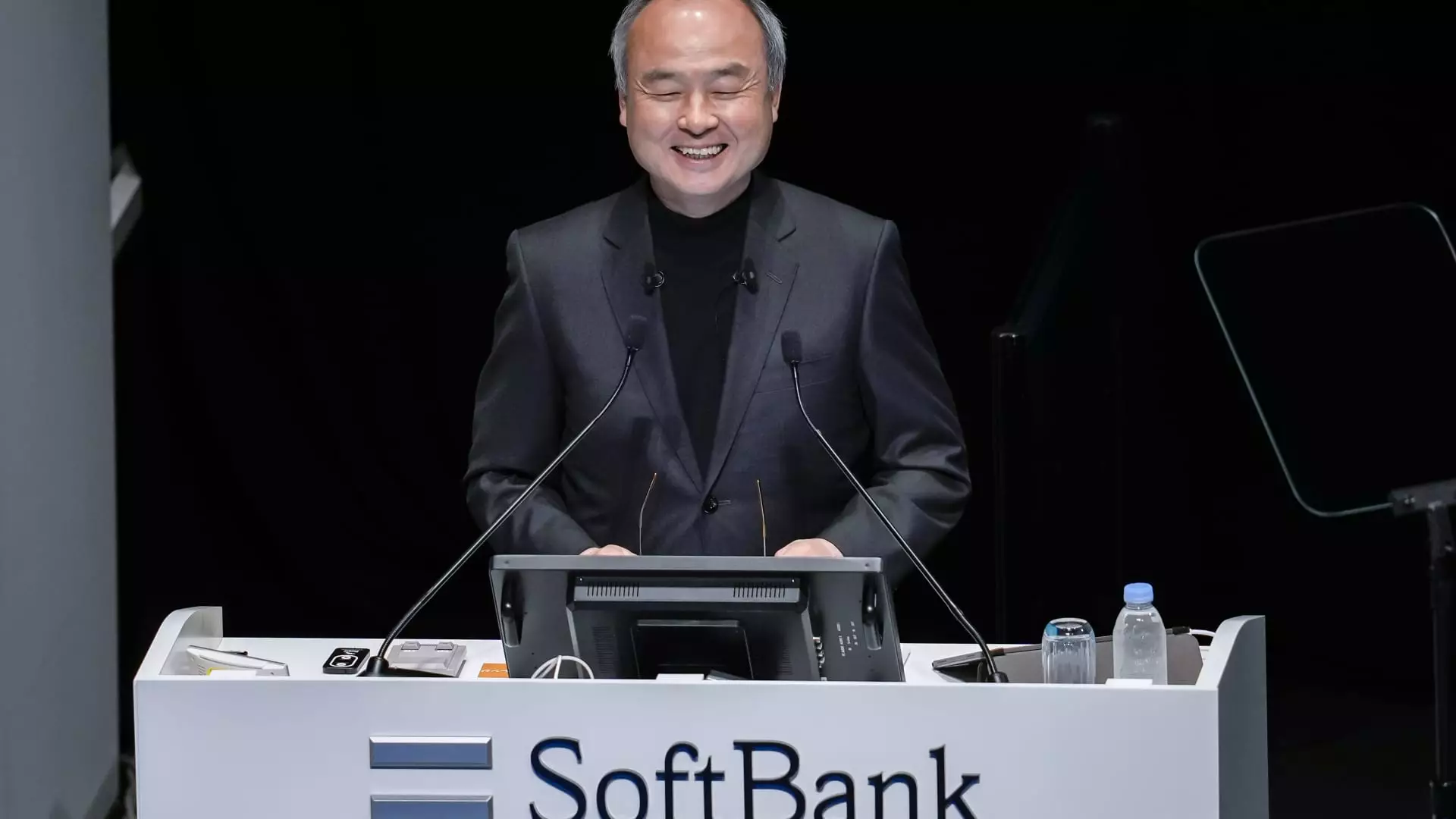

SoftBank’s CEO, Masayoshi Son, has long been recognized for his audacious investment strategies, but his recent commitment to OpenAI is arguably one of his most ambitious moves yet. Whereas traditional investors might tread cautiously with startups that remain unprofitable and private, Son is doubling down with a planned investment staggering at approximately $33.2 billion. His unwavering confidence in OpenAI’s future underscores a broader vision—not merely about capitalizing on AI today, but about steering the trajectory toward what he calls “artificial superintelligence,” an intelligence that could vastly surpass human capabilities.

This degree of commitment from SoftBank, a multinational Japanese conglomerate, highlights how seriously this company views AI as an industry-defining force. Son’s readiness to commit billions—despite the inherent uncertainty—is a testament to his distinctive blend of foresight and risk tolerance.

Challenging Conventional Partnerships and Market Dynamics

What stands out in SoftBank’s narrative is the underlying strategic duel with Microsoft, which initially secured a pivotal partnership with OpenAI. Microsoft’s exclusive rights to the OpenAI cloud infrastructure and its reputation as a tech giant seemed to position it as the uncontested leader in this AI revolution. Yet, cracks are emerging in this alliance, evidenced by Microsoft’s hesitations about OpenAI’s proposed restructuring to a for-profit model.

Son’s reflection that OpenAI might have been better off partnering with SoftBank instead of Microsoft reveals much more than a missed investment opportunity—it signals a clash of corporate cultures, investment philosophies, and long-term ambitions. SoftBank, although smaller at the time, brings a different playbook: less reliance on established corporate pipelines and more focused risk-taking to revolutionize industry ecosystems. This contrast offers a nuanced look at how physical scale, reputation, and financial heft aren’t necessarily decisive factors in innovation-centric collaborations.

Forging an AI-Centric Industrial Ecosystem

What differentiates SoftBank’s approach is that Son doesn’t just want to invest—he wants SoftBank to become the nucleus of an entire industrial complex centered around artificial intelligence. His goal of creating AI that is not just incrementally better but exponentially smarter than humans (10,000 times smarter, in his own words) signals a bold, future-oriented agenda that most corporations shy away from due to its inherent uncertainties.

This future-focused vision is supported by strategic acquisitions and partnerships. For example, SoftBank’s ownership of Arm, a British semiconductor giant, combined with its more recent acquisition of American chip designer Ampere illustrates this holistic approach. Rather than focusing solely on software or AI algorithms, SoftBank is integrating hardware capabilities, crucial for running advanced AI computations at scale, empowering it to position itself as a comprehensive platform provider.

Moreover, reports of Son considering a $1 trillion industrial complex in the U.S. underscore that SoftBank’s ambitions aren’t limited by geography or industries. Instead, they are weaving a vast, interconnected AI ecosystem that spans from core components to cloud platforms, firmly entrenching SoftBank at the heart of the next technological wave.

Risk, Reward, and the Strategic Gamble

Critically speaking, while SoftBank’s dedication to OpenAI is admirable, it also represents one of the highest-risk gambles in the tech investment landscape today. Investing tens of billions into a deeply unprofitable, unlisted company banking on speculative technology requires more than optimism—it demands unwavering faith in the disruptive potential of AI as well as a degree of hubris.

However, Son’s history suggests this isn’t blind faith. SoftBank’s Vision Fund track record, despite notable setbacks, reflects a pattern of thinking big and betting on long-term transformational outcomes, even when near-term returns are uncertain or negative. This mindset, combined with evolving AI capabilities witnessed worldwide, suggests that what looks dangerously speculative today could become the defining asset of tomorrow’s tech economy.

The question is whether SoftBank can effectively balance its enormous financial exposure with the operational and strategic challenges that will come from establishing itself as the “organizer” in an era of artificial superintelligence. If it succeeds, the company won’t just be a backer of AI innovation—it will be its central architect, shaping everything from infrastructure to AI governance in profound and unprecedented ways.

Leave a Reply