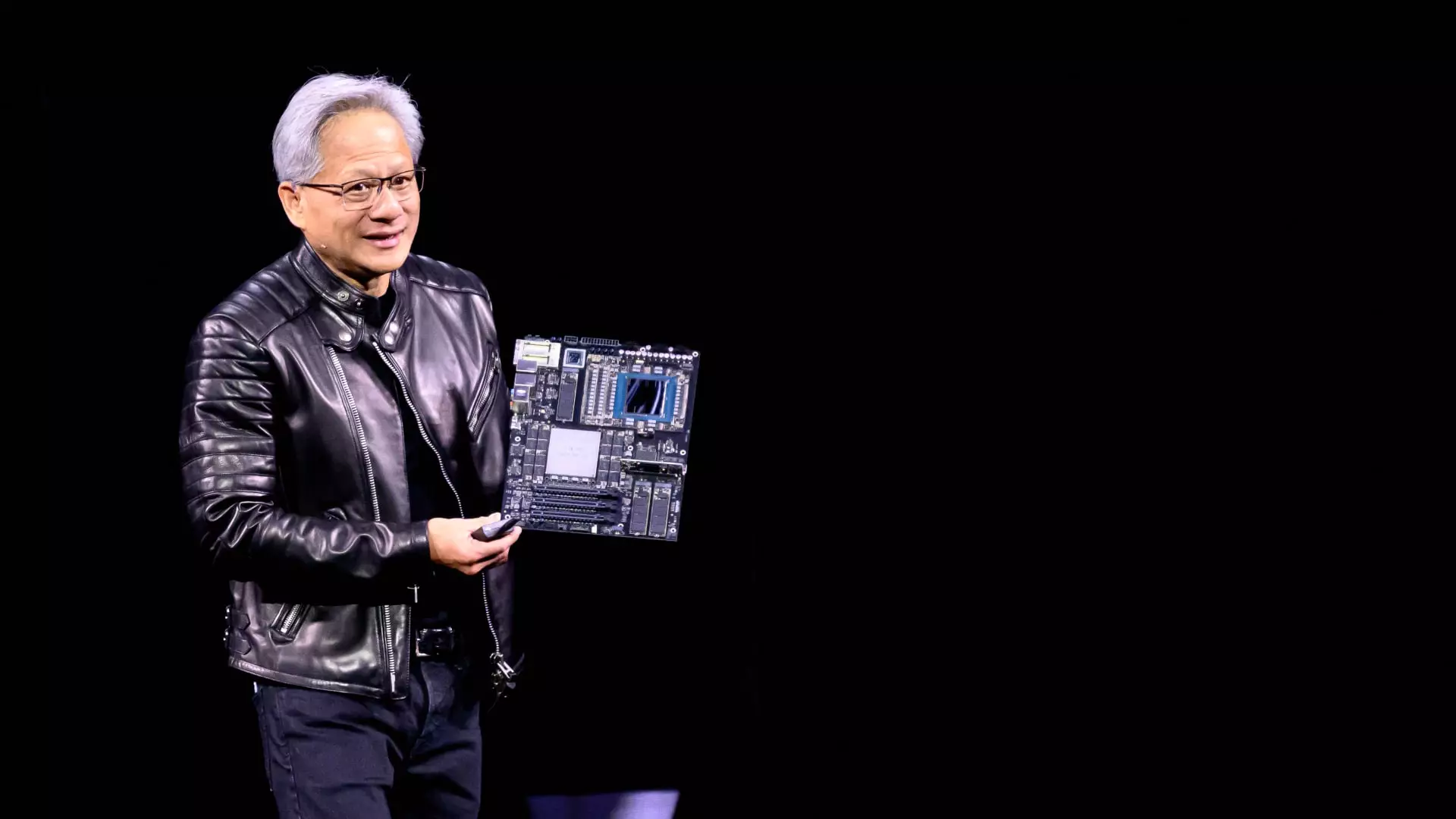

Nvidia has been carving its path as a leader in the artificial intelligence landscape, but the recent keynote by CEO Jensen Huang at the GTC conference unveiled an aggressive roadmap that spells out an ambitious future for AI-powered technology. Instead of merely showcasing products, Huang painted a larger narrative about the immediate and long-term implications of Nvidia’s innovations, particularly regarding the revolutionary Blackwell Ultra chips. His message was emphatic: the audience must harness these powerful chips now to spearhead their ventures in AI.

This isn’t just a product launch; it reflects a paradigm shift where speed and efficiency become the bedrock of business strategy for tech titans. Huang candidly stated that enhanced performance would eclipse concerns surrounding costs, which is a compelling invitation for organizations to invest heavily in Nvidia’s offerings. By reducing the time required for AI computations, businesses can achieve greater scalability, rolling out applications that serve multiple users simultaneously without breaking a sweat.

The Economics of Speed: AI as a Cost-Reduction Strategy

Huang’s insights into the economics of chip performance are particularly compelling. He argued that the cloud’s future investment strategy hinges on adopting cutting-edge technology that allows for a drastic reduction in operational costs. During his presentation, he delved into analyses illustrating how the cost per unit of AI output can be transformed with faster chips. This focus on cost-per-token metrics signaled a shift toward a more economically driven evaluation of technology acquisition.

The Blackwell Ultra systems hold promise for delivering unparalleled revenue potential — reportedly 50 times what the older Hopper systems could achieve. This translates into a game-changing opportunity for cloud providers like Microsoft, Google, Amazon, and Oracle, who are already racing to acquire these high-performance GPUs. Such increased demand reflects a thirst for robust AI solutions, as organizations prepare to invest hundreds of billions into AI infrastructure over the next few years.

Competitive Landscape: Addressing Industry Concerns

As Huang confidently addressed investors and journalists, there remains an undercurrent of apprehension regarding future capital expenditures for AI chips among the four major cloud service providers. The steep price point of Blackwell GPUs—estimated around $40,000 each—raises questions about the sustainability of growth in demand. Huang, however, appears unwavering in the face of these potential doubts. His commitment to maintaining Nvidia’s supremacy against emerging competitors from custom chip developers demonstrates a deep understanding of the industry’s needs and a clear belief in his products’ superiority.

While some companies are attempting to forge their silicon pathways with Application-Specific Integrated Circuits (ASICs), Huang was dismissive about their potential to threaten Nvidia’s position. His experienced perspective underscores the fact that these custom solutions might lack the adaptability necessary to keep up with rapidly evolving AI applications. Huang’s skepticism regarding the viability of many ASICs punctuates a larger narrative: flexibility and performance are non-negotiable in tomorrow’s tech landscape.

The Road Ahead: Preparing for the AI Boom

Nvidia’s relentless innovation doesn’t stop with current products; Huang offered tantalizing glimpses into the future with roadmaps for upcoming AI chips, namely the Rubin Next and Feynman systems, expected in 2027 and 2028, respectively. This forward-thinking approach is strategic; cloud providers need to plan their infrastructure investments well in advance, making it essential to understand the trajectory of Nvidia’s developments.

The enormity of the financial stakes involved in building AI infrastructure emphasizes Huang’s assertion about the scale of investment required. As budgets and operational parameters are greenlit, it becomes crucial for companies to align their strategies with Nvidia’s cutting-edge technology. The question Huang poses to executives—“What do you want for several hundred billion dollars?”—challenges businesses to consider the best possible investment strategy in this burgeoning landscape.

In an evolving industry where innovation is swiftly outpacing the competition, Huang’s uncompromising emphasis on speed and performance positions Nvidia not just as a supplier but as an ally for groundbreaking AI advancement. Organizations must weigh their options carefully, as the winner in this race will not merely be those who adopt the latest technologies but rather those who embrace them with the urgency they deserve.

Leave a Reply