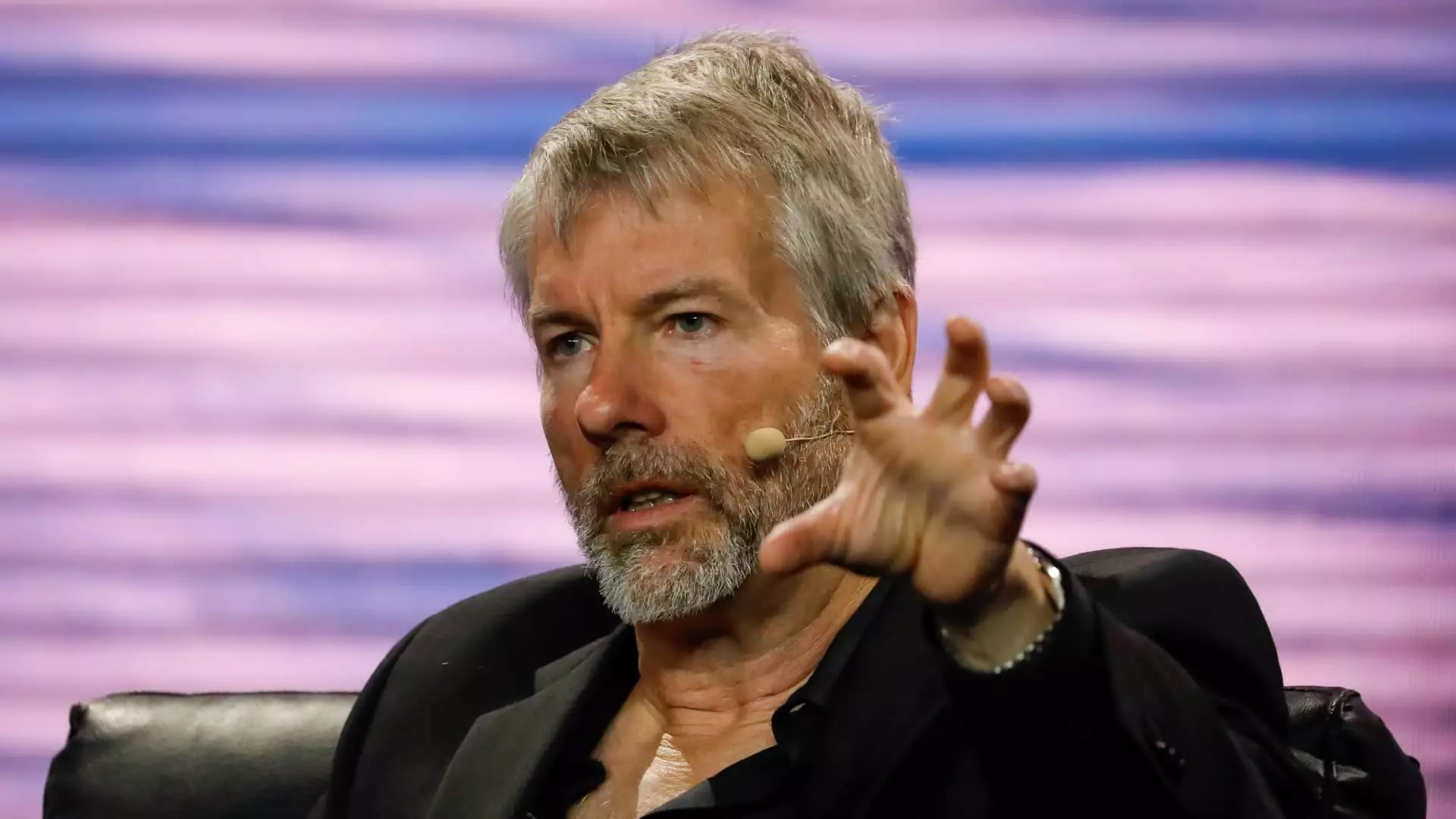

Michael Saylor’s recent announcement of MicroStrategy purchasing an additional 12,000 bitcoins for $822 million has caused a surge in MicroStrategy’s stock value. Saylor’s continuous endorsement of Bitcoin has a direct impact on the company’s performance in the market. His statements regarding Bitcoin’s potential and the company’s strategic investments have been driving up MicroStrategy’s stock value.

MicroStrategy, a company traditionally focused on software development, has significantly shifted towards being a proxy for Bitcoin. The company’s decision to invest in Bitcoin has proven to be lucrative, with their total holdings now exceeding 205,000 bitcoins, valued at over $15 billion. As Bitcoin continues to reach new highs, MicroStrategy’s stock value has seen a significant increase. The company’s stock surged by 11% following Saylor’s latest announcement of the Bitcoin purchase.

MicroStrategy’s recent purchase of bitcoins was financed through the proceeds from convertible notes and excess cash. The company completed an offering of 0.625% convertible notes due in 2030, raising approximately $782 million. This move showcases the company’s strategic approach to leveraging its financial structure to fund its Bitcoin investments. Canaccord Genuity analysts highlighted the uniqueness of the convertible notes offering, emphasizing the low coupon rate and high conversion premium.

Despite the rapid appreciation of Bitcoin, MicroStrategy’s stock value is outpacing the value of the bitcoins purchased. The company’s equity value premium over its Bitcoin holdings has seen a significant increase, reaching up to 99% according to Canaccord’s methodology. This growth highlights the strong correlation between MicroStrategy’s stock performance and its Bitcoin investments. MicroStrategy’s shareholder value is predominantly tied to its Bitcoin holdings, with significant growth in market cap since the company’s initial investment in mid-2020.

Founded in 1989, MicroStrategy initially focused on enterprise software and cloud-based services. However, the company’s decision to invest in Bitcoin has transformed its business model. As MicroStrategy’s market cap has soared from $1.1 billion to $30 billion, the company’s value proposition has shifted towards being a key player in the cryptocurrency market. The strategic investments in Bitcoin have significantly contributed to MicroStrategy’s shareholder value and market performance.

Overall, Michael Saylor’s advocacy for Bitcoin and MicroStrategy’s strategic investments in the cryptocurrency have positioned the company as a prominent player in the market. The continuous surge in MicroStrategy’s stock value following Bitcoin-related announcements demonstrates the significant impact of digital assets on traditional businesses. As the cryptocurrency market continues to evolve, companies like MicroStrategy are leveraging these opportunities to drive growth and investor interest.

Leave a Reply