Snap Inc., the parent company of Snapchat, recently released its latest performance update which showed mixed results. While the platform gained more users overall, it experienced a decline in its most lucrative markets. Additionally, its revenue increased but fell short of expectations. These inconsistencies are a recurring theme in Snap’s performance, presenting both strengths and weaknesses in various aspects.

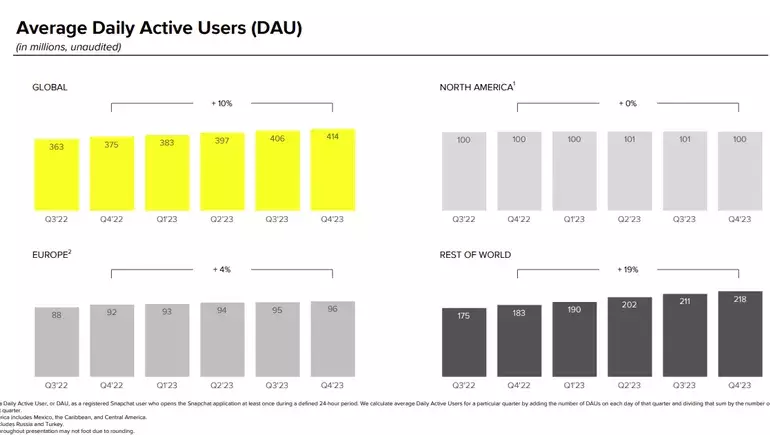

Snapchat’s daily active users (DAU) rose to 414 million in Q4, representing a 10% year-over-year increase. However, the loss of one million users in North America during the holiday season is a significant concern. The majority of Snap’s growth continues to come from the “Rest of the World” segment, which has been the trend over the past year. Although Snapchat has seen rising interest in India, the company plans to shift its focus towards more mature markets like North America and Europe. This change in approach aims to prioritize community growth in these regions.

Snap reported significant increases in user engagement metrics. The total time spent watching its TikTok-like Spotlight feed increased by over 175% year-over-year, while average monthly active users on Spotlight grew by more than 35% year-over-year. These numbers reflect the growing popularity of short-form video content. As a result, Snap has discontinued funding for its Snap Originals programming, redirecting its efforts towards collaborating with popular creators on new initiatives. Public Stories posted by Snap Stars saw a notable 125% year-over-year increase in the United States. Snap is also working on helping creators secure brand deals to establish a more sustainable revenue-sharing process.

AR remains an area of opportunity for Snap, with over 350,000 creators and developers having built almost 3.5 million AR Lenses for the app. On average, 300 million Snapchatters engage with AR every day. Converting this engagement into expanded business offerings could play a vital role in Snap’s future success. However, the company had to make cost-cutting measures, leading to the shutdown of its third-party AR development platform ARES. Balancing revenue generation and cost reduction proves to be a challenge for Snap’s overall business strategy.

Snap reported quarterly revenue of $1.36 billion, a 5% year-over-year increase. Though this growth is commendable given market conditions, it fell short of market expectations. One significant hurdle for Snap is the stagnant user growth in its key revenue markets, North America and Europe. This is concerning when evaluating the average revenue per user, as it is considerably lower in the “Rest of the World” category, where the majority of Snap’s growth is coming from. Moreover, it has declined over the past year. These figures suggest potential flaws in Snap’s evolving business plan. According to CNBC, this performance report marks six consecutive quarters of single-digit growth or decline, emphasizing the company’s struggle to capitalize on its user growth.

While Snap has the potential with its 414 million active users, it still fails to attract users outside its core demographic and age group. The platform exhibits minimal usage among older audiences compared to other major social apps. This niche audience limits Snap’s business potential as it attracts fewer brands looking to reach this demographic. Furthermore, Snap’s AR ambitions have faced setbacks due to layoffs and cost-cutting measures. With competitors like Apple and Meta entering the AR race, it seems challenging for Snap to regain its leading position. However, Snap’s CEO, Evan Spiegel, remains focused on AR despite the company’s cost-cutting measures, expressing criticism towards Meta’s metaverse push.

Snap Inc.’s performance update showcases a mixture of positives and negatives. While it remains a prominent connector for users, particularly among teens, its value for investors depends on its ability to regain solid revenue growth. The challenges of user growth, revenue generation, audience expansion, and competition in the AR space are critical considerations for Snap’s future prospects. With a growing user base and potential for innovative content and AR experiences, Snap has opportunities to evolve. However, it needs to carefully address the weaknesses and contradictions within its business strategy to establish long-term success.1>

Leave a Reply